By Chris Berry

- Recent volatility in emerging markets has many worried that this is the start of a global correction

- We do not necessarily agree and believe that new concerns about emerging markets are overblown

- The culprit may be the lax monetary policies of central bankers that have bred complacency

- The key to interpreting the potential for emerging markets mirrors our strategy for interpreting opportunities in the metals space – selectivity

- Several emerging market economies are in better shape with respect to fiscal and monetary policy than the “recovering” developed world economies

- Frontier Markets are the new game in town

The Luck Of The Draw

I’m always the first to admit how fortunate I’ve been in life. I’ve had numerous opportunities to travel to other countries throughout the world, talk to people in all walks of life, and see the world through a non-US prism. Viewing different (and mostly) lower standards of living sparked my interest in the emerging markets and the well known idea of convergence. See Nobel Laureate Michael Spence’s book titled “The Next Convergence”.

Economic growth in the developed world is slow and volatile, well below “escape velocity” for 62 months. The most recent example is sluggish jobs numbers in the US last Friday (only 113,000 jobs created).

For the past decade, investors have pinned their hopes on emerging market growth, specifically the new middle class in China and the other BRIC economies. This urbanization was (and still is) the engine of global demand.

However, most of the emerging markets (EM) have seen their growth rates slow down rather sharply. One might think that the growth miracle in the emerging world has run its course. Bill Gross, of PIMCO, one of the largest asset managers in the world, has recently called China's growth the "mystery meat"1 of emerging markets. This is not a ringing endorsement of the future.

The reality is much more complex, but we continue to believe that the slowdown in EMs is a temporary phenomenon and not a long-term structural change.

Who's To Blame?

Many believe that the culprit for the current EM turmoil is the Fed’s tapering of Treasury and mortgage-backed asset purchases now down to a mere $65 billion each month. This may be accurate, but the after effects have added confusion.

The conventional wisdom forecast that as the Fed stopped flooding the world with US dollars, interest rates would rise, and money that was invested in foreign stocks and bonds would leave the EMs, hammering currency values and current account balances. This has partially played out. Emerging market fund outflows to date of $18.6 billion in 2014 have exceeded their total for all of 2013.

EM currency values have been hit hard as we can see below. The fall in interest rates (as measured by the US 10 Year Note) since tapering commenced is a surprise to many, myself included, until I realized that outflows from the EMs headed back into US Treasuries.

Argentina, Turkey, and other countries have intervened in the markets to support their currencies. This has occurred primarily through interest rate increases and largely to no avail. The Canadian and Aussie dollars have also declined.

The Twin Forces That Really Matter

It is true that growth in EMs has slowed. However, we believe that these countries have two unique forces propelling them forward:

- favorable demographics and

- lower debt to GDP ratios

The key to our research is to focus on a country's working age population, specifically the growth in this segment of society. In Europe and the US, the working age population is forecast to stagnate with growth of less than 1% per year going forward.

By comparison, the size of the working age population in the EMs is forecast to grow by anywhere from 1 to 2% per year in the future. However, it is important to remember that not all EMs are created equal and this projected growth rate is an average rather than an absolute.

A larger workforce means more production, more income, and more consumption, the bedrock behind steady and increasing commodity demand we have forecast in the past.

We continue to believe that just as not all EMs are created equal, neither are all commodities. In particular, attention should be focused on the supply and demand dynamics behind each. In recent years, as capital has been invested in expanding capacity, this has hurt the bullish case for select commodities as demand has fallen, implying an excess supply and lower prices.

This is why I continue to believe that the lithium junior sector is troubled.

How To Tell If A Population Will Survive—Population Pyramids

To understand a given demographic, population pyramids are instructive. These charts show the percentage of a given country’s population grouped by age. The more “triangular” the pyramid, the better the long-run demographic picture. I think these charts speak for themselves vis-à-vis future investment opportunities.

Here are some examples of countries with favorable demographic profiles forecast in 2015:

Colombia

Mexico

Pakistan

The African Continent

…and some troubling population pyramids:

Europe

China

United States

As you can see, the demographics in the developed world and China are challenging, to say the least.

The typical EM paints a different picture. China is an interesting case, still considered by many to be an EM, but with a truly terrible demographic picture. The reversal of the One Child Policy couldn't have come soon enough!

Put simply, a younger workforce has the potential to produce and consume longer and forms the backbone of a growing consumer middle class.

Paying The Piper

A country’s fiscal and monetary standing is almost as important. It is most easily measured by debt to GDP ratios (though there are other metrics). A lower debt to GDP means that a country can “plow” back the wealth it creates into its economy, increasing its capital stock. A high debt burden means that the interest payments on the debt which must ultimately be serviced divert wealth from more productive uses. In a deflation, a high debt to GDP ratio is anathema as debt becomes more expensive.

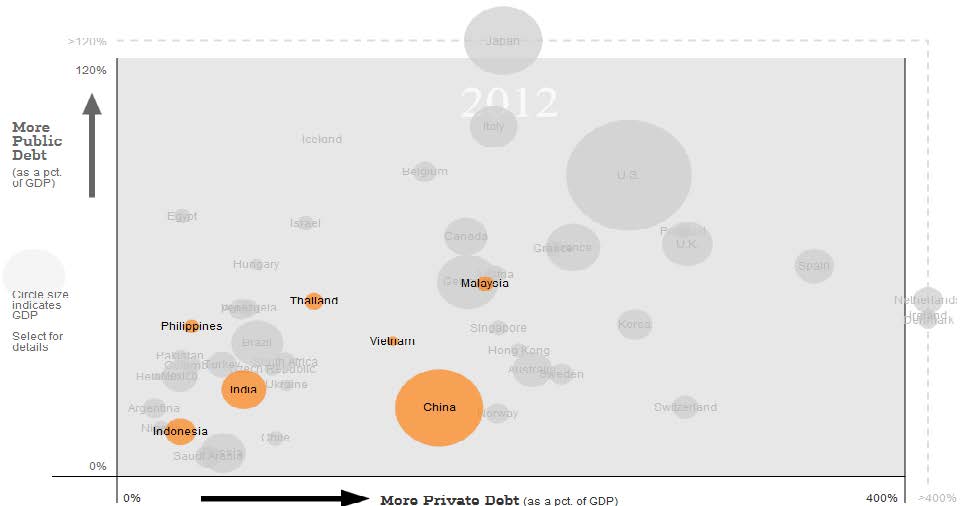

Below is a recent chart from the Wall Street Journal showing the debt burden of various economies (both EM and developed):

My only comment, as an aside here, is to lament the legacy that politicians and central bankers are impoverishing our children and grandchildren with for many years to come. It is a global phenomenon and they are impoverishing the future with debt that cannot be repaid.

Here is the same chart only showing the debt burdens of select EMs:

Shadow banking, or unofficial lending, is not included here and could change the picture in the case of China. Nevertheless, the charts demonstrate a telling picture of debt burdens around the globe.

Favorable demographics and low debt to GDP are no guarantee of growth and enhanced returns in EMs going forward, but we believe that these factors outweigh any near-term structural issues.

Arguments can also be made for world class technological infrastructure being in place in many of these EM economies which acts as a growth and productivity driver.

The Near Term Risks

To be clear, the near-term picture for EMs is one characterized by volatility. According to Ian Bremmer, head of The Eurasia Group, there are elections in 44 EMs in 2014. This is the most since 2007. With any change of leadership comes the potential for increased volatility in financial markets.

Another point to underscore – perhaps the most important in today’s Note – is that all EMs aren’t created equal. Some are better positioned than others. Argentina seems to be the poster child for the economy hit the hardest from Fed tapering, but other economies are in similarly bad shape including India, Indonesia, Brazil, Turkey, and South Africa. These economies have been referred to as the “Fragile Five” as they share some unfortunate similarities including fiscal and current account deficits, falling growth rates, high inflation, and political uncertainty.

China’s many challenges also loom large including a shadow banking system of indeterminate size created by a credit-driven binge that refuses to stop for fear of bringing economic growth to a screeching halt. Below, I include a chart from Grant’s Interest Rate Observer on the trajectory of credit growth in China, the US, and Japan:

These data points should concern even the biggest China bull. China’s political leadership must slow this growth while still providing opportunities for their growing consumer class. This issue, coupled with growth slowing (as measured by GDP and PMI), is likely one of the biggest economic issues of 2014.

As I said above, all EMs are not created equal and a new class of EM, commonly referred to as “Frontier Markets” has gained the attention of investors.

The Takeaway

Despite the many risks highlighted above, I think the meme surrounding the death of the EMs is a non-story. The longer-term rationale for investing in the growth in these markets, and the Frontier Markets as well is still intact. The idea of billions of people leading more commodity-intensive lifestyles going forward is a powerful one with staying power as you can’t just put the “genie back in the bottle” to borrow a cliché. Despite their problems, the EMs still offer the greatest potential for returns over the long-term.

Late last year, we wrote a Note on some of the metals we’re focusing on in 2014 (see the note from Friday, December 13, 2013). This idea of selectivity can and should be applied to the EMs as well. I outlined some countries that appear more troubled than others, and so the opportunity to learn more about the potential of the Frontier Markets should be embraced as this shakeout continues. There is a big difference between the outlooks for phosphate relative to lithium in the same way there is a big difference in the outlooks for Kenya relative to Argentina.

We will be writing further on emerging and frontier markets in future notes. This will be key to your wealth creation and preservation strategy in 2014.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at Morning Notes make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect.