By Chris Berry

The Institute of Supply Management released its January 2014 survey yesterday.

While the survey still indicated growth in the US Manufacturing sector (at a reading of 51.3), the consensus estimate called for a reading of 56.

This was a substantial “miss” and equity markets collapsed with the Dow falling 326 points, or over 2%.

The ISM reading, coupled with increased volatility in emerging markets such as Argentina and Turkey, have many thinking that the long awaited correction and rebalancing of growth in financial markets is upon us.

Two questions remain – First, have the Emerging Markets entered a crisis phase or is slowing growth in the developed world a bigger issue? Second, Can the Fed continue to taper asset purchases in the wake of this volatility and possible economic weakness in the US?

Significance of the ISM

Regular readers of Morning Notes will know of my preference for ISM and PMI data as a gauge of industrial demand. If industrial demand is increasing and economic expansion is occurring, this is ultimately bullish for the base and energy metals complexes.

Since last summer, the ISM numbers in the developed world (the US and Europe) have ticked up and lent credence to the idea of a slow, possibly sustainable, economic recovery.

The chart demonstrates my point. A PMI reading above 50 indicates expansion in the economy’s industrial base. The last contraction occurred in late 2012; it has been assumed that the US economy is on track for a slow but steady recovery.

Emerging Markets are Reeling

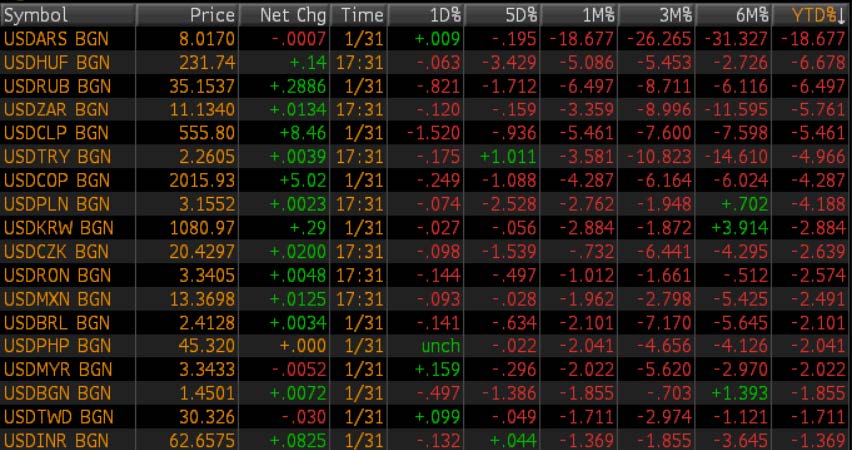

Despite the generally positive economic news in the US, many in the market participants are growing increasingly concerned that the Fed’s tapering of asset purchases has unleashed a “run” on various emerging market (EM) economies and a look at the YTD performance of various EM currencies below would seem to lend credibility to this theme.

Source: Bloomberg

A sea of red indicates that investors are not so sure any more about the growth prospects for Emerging Markets in the absence of Federal Reserve easy monetary policies.

Source: Bloomberg

As the Fed has continued to taper QE (for now), investors have interpreted this as a need for a flight to safety out of EMs and into other asset classes. As EM currencies have continued to slide, this has forced central banks in countries such as Argentina and Turkey to defend their currencies and support their current accounts with market interventions. Another gauge of confidence (or lack thereof) involves credit default swaps. The chart below shows credit default swap (CDS) spreads. A CDS spread is an indicator of a country’s creditworthiness with a wide spread being a harbinger of default.

It is no surprise to see countries whose names have been in the news for all the wrong reasons recently have the widest CDS spreads.

Much of the EM outflow has seemingly found its way back into US Treasuries which is a surprise to many. Higher yields were anticipated in 2014 on the back of an improving US economic situation and the tapering of asset purchases which had served to keep interest rates artificially low. Thus far this thesis has not unfolded as many thought it would, though we’re still only one month into the year. The US 10 Year yields 2.57%.

Source: Bloomberg

The US 10 Year Government bond yield continues to fall in the wake of a collapse of confidence in Emerging Markets. This appears to be a classic flight to safety. Is this inflationary?

Where is the Real Crisis? EMs or the Developed World?

The Federal Reserve holds the answers to these questions, specifically with their actions regarding tapering. The mandate of the Fed (aside from price stability) is to nurse the US economy back to health – not the Argentine economy, or the Turkish, or any other country. Essentially, with the curtailing of asset purchases, the Fed has signaled the EM countries - “you’re on your own”.

It remains to be seen if this strategy will end well – for both the US and the EMs.

Despite many market participants who think this EM collapse coupled with yesterday’s slowing ISM and stomach punch to the Dow is the start of an equity market correction, it is still too early to tell. One month of data with subsequent volatility doesn’t erase the many disinflationary forces which predominate such as a collapsing velocity of money, a shrinking money supply, and labor market slack.

In short, there is a crisis in both the developed and emerging world. They have occurred for different reasons and likely have different solutions.

However, in an effort to deliver a balanced analysis, yesterday’s ISM reading did offer one intriguing data point which could be interpreted as inflationary: prices paid increased by 7 percentage points month-over-month and have been increasing for the past six months.

Source: http://www.ism.ws/ismreport/mfgrob.cfm

Could this be the first whiffs of inflation? It is wrinkles in data like this that the Fed must pay attention to as it slows the pace of QE. As Dr. Yellen takes the reins of the Fed, the metaphors of walking on a tightrope or having painted the economy into a corner are apt. With wages flat on a real basis in the US, Dr. Yellen must keep asset values inflated. It is the 20% of American earners who are lucky enough to have income to invest. They are powering consumption in the US economy. With easy monetary policies seemingly tapering, a collapse in the stock market would reverse the “wealth effect” that has served so few so well since 2009. If those with ample liquidity withdraw from the market, the losses and volatility we’ve seen so far in 2014 will seem small in comparison.

The Takeaway

Despite the volatility we have encountered in the markets in 2014, a global deleveraging must continue and this will hamper central banks attempts to stoke inflation. It is crucial to pay attention to data series such as PMI or ISM surveys as they can hold clues as to the direction of economic growth. Overall the global economy still must continue to deleverage along with slow and intermittent growth. Many are blaming this ISM report on the weather and this does have some validity. That said, more data is necessary to establish a trend and we will be watching.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at Morning Notes make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect.